Union Street Railway

Below you will find another case study from the Buffett with “more ideas than money” years. Thanks go out to a regular reader for sending me the Moody’s sheet.

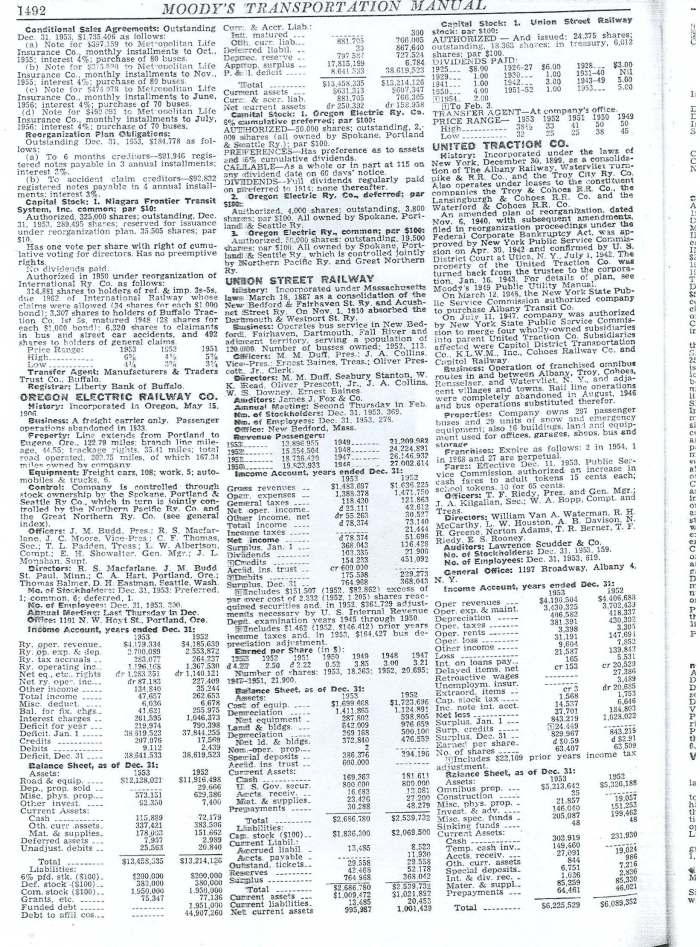

During a question and answer session with University of Kansas students in 2005, one student asked what he would do differently given his belief that “it’s a huge structural advantage not to have a lot of money.” Buffett went on to say that with small capital he would look for “little anomalies, companies that are off the map – way off the map.” An example given was Union Street Railway of New Bedford, Massachusetts that was “selling at $30 when $100 is sitting in cash.”

You will see below page 1492 of the 1954 Moody’s Transportation Manual. At the time of this publication Buffett was three years removed from graduating from Columbia and was working for his father’s brokerage firm in Omaha. I believe it was around this time when he came across Union Street, an example he frequently provides students of a small, obscure cheap cigar butt-type investment.

Union Street operated a bus service near New Bedford, an area containing about 120,000 people. The company owned 113 buses in total (more about these in Alice Schroeder’s book). Union Street was a business in decline as evidenced by the drop in revenue passengers from 27 million in 1946 to 13.9 million in 1953, to the point where the business was operating in the red. Looking to the balance sheet you would see why an enterprising Graham-Dodd investor would be interested. You will see listed in current assets, cash and U.S. government securities totaling $969,363, or $52.79 per share. As Buffett mentioned the stock was selling around $30 per share, or $32 to $38.50 in 1953. If you look in non-current assets you will see two line items labeled “Special Deposits” and “Accid. Ins. Trust” which were $386,376 and $600,000 respectively, or $53.72 per share. Adding it all up, you had $106.50 per share in cash and cash-type items. The company had no debt to speak of. There were 18,363 shares out, so at $30 per share the market cap was $550,890, which is roughly $3.7 million in today’s dollars.

Incidentally, you may notice one of Union Street’s directors listed is Seabury Stanton. Stanton was running another New Bedford-based company at the time named Berkshire Hathaway. Like Ken Lewis unknowingly saved the U.S. economy, Stanton unknowingly saved Berkshire. As the story goes, Buffett, whom owned roughly 10% of the outstanding shares, came to an agreement with Stanton to tender all of his Berkshire shares to the company at $11.50. The following week, Stanton sent a letter indicating a tender for his stock at $11.375 per share. This low-ball offer angered Buffett leading him to continue buying up more Berkshire shares, eventually gaining control of the company. If Stanton would simply have tendered Buffett’s stock at the agreed upon price, we likely would never have heard of Berkshire Hathaway.

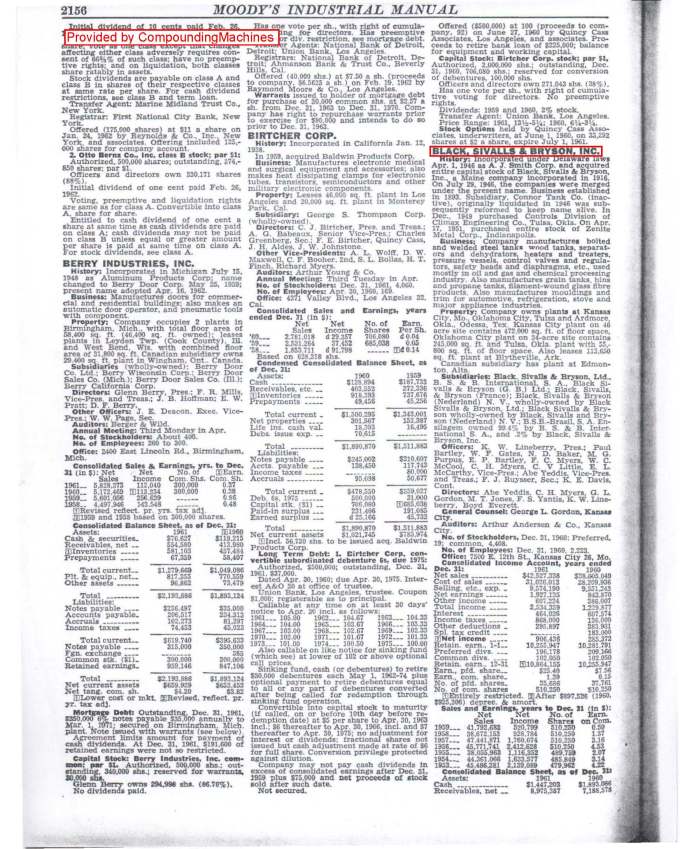

Black, Sivalls & Bryson, Inc. (circa 1962) = Cigar Butt

Here is another holding from the 1962 year-end statement of the Buffett Partnership Ltd. Black, Sivalls & Bryson, Inc. (BS&B) was the 18th largest holding (18/54) accounting for 1.8% of the net assets. Buffett owned 13,353 shares @ $13.31 per share, totaling $177,762.

This company was a cigar butt! It manufactured bolted and welded steel and wood tanks, separators and dehydrators, heaters, valves, etc., for use in the oil and gas and chemical processing industry. It also manufactured grain and propane tanks, as well as moldings and trim for the auto, refrigeration and appliance industries. The company had 510,250 common shares outstanding for a market cap of $6.8 million. In 1961, it earned just over $0.9 million after-tax, or $1.39 per share, but it was most likely the balance sheet which drew Buffett to this company. At year-end 1961, it had $36 per share in net current assets (current assets less current liabilities) and $24.25 per share in net-net current assets (current assets less total liabilities). Even if you classify the preferred stock as debt, net-net current asset value is $17.26 per share. The company had $2.84 per share in cash and owned over 750,000 square feet of real estate in Missouri, Oklahoma and Texas. I have no idea when BPL purchased BS&B, but it would appear to me that at $13.31 per share, there was a significant margin of safety in the nearly 50% discount from net-net current asset value, exactly what Buffett was looking for in those days.

2009 Sears Holdings Annual Meeting Notes

The Monday following the Berkshire meeting, I attended my second SHLD in as many years. Overall, I felt both the questions and answers were a step back from last year. You can find my (disorganized) notes below.

2009 Sears Holdings – Annual Meeting Notes

Monday May 4, 2009 – Hoffman Estates, IL

CompoundingMachines.wordpress.com

1.) Bruce Johnson, interim CEO, opened the meeting with a brief presentation.

– Disappointed with 2008 performance caused in part by excess poor economy

– Chart shows that relative to SHLD’s largest 12 competitors, SHLD’s comps exceeded 9/12 in the Q4….in the past SHLD was one of the worst

-K-Mart improved profitability by 18% in Q4….among closest competitors; WMT was the only other one able to do this

-Layaway was a success in Q4, added 1.4 million new layaway customers, which has the ancillary benefit of getting them in the stores every two weeks to make payments

Market Shares:

– Appliances: 34.6% (regained momentum in 08 with Blue Crew ad campaign…market share went from 30% in Q107 to 34.6% at end of 08)

– Tools: 22.3% (working on invigorating Craftsmen brand)

– Power lawn and garden: 21% (expanding Blue Crew to lawn & garden)

– Home repair: 14%

-working on building home brands in 09 (Cannon, Jaclyn Smith)

-Sears apparel business has been and still is quite challenging….Land’s End does well as reported in the shareholder’s letter, but they are focusing on these brands: Carter’s, Arrow, LL Cool J, Oshkosh

-Bringing Protégé shoes (sponsored by NBA player Al Harrington) to Sears stores in July

Q&A w/ Lampert

-Question about prototype stores and what was learned from Sears Grand/Essentials stores (neither of which worked as well as planned):

- Can we make the existing real estate footprint useful post Wal-Mart Supercenter world

- Selling off real estate was never intention. Whether that was a good decision remains to be seen.

- My Gofer – service as much as it is a store, a fulfillment warehouse

- Want to make it easier for customers to shop

- Question is whether it resonates with customers (Essentials did not)

- “I want to get it right.”

- Trying to encourage customer involvement/interaction

-Eddie comments on creating an internal system, P&L for each business unit to increase focus on profitability

- Rights of each business unit

- Real estate unit to be responsive to third parties for utilizing store space

- Significant space dedicated to apparel

- Unproductive productivity (?)

- Giving each area a P&L, cap ex

- Compared old system to socialist system

- Allowing people to run at their own pace that way

-How much do you listen to people?

- Encourage experiments

- Encourage employee feedback

- Proud of progress

- Want to position the business to benefit on upside, operating leverage on upside

- Don’t go in shell

-Biggest disappointment and discussion of retail operations:

- Biggest disappointment was failure of Kmart prototype stores

- Specialty retailers took advantage of one-stop shops

- Home & auto service will be managed as brands going forward

- People are changing the way they make decisions

- Asking how do we communicate with customers if half of newspapers go away

- Order online and pick-up in store is coming to Kmart

- Where people chose to shop depends on what’s going on online with friends

- Online appliance experience is the best

- They have 200 million square feet of space they need to maximize

*NOTE: at about this time I took notes less frequently as the questions got worse and worse. Overall, the quality of the questions and answers left a lot to be desired this year.

-Book recommendations:

- From Third World to First

- Road to Serfdom

-Other comments/responses:

- When you get incentives aligned properly, the odds are much greater for a good outcome. The biggest mistakes come from misaligned incentives.

- Would like to have sales go up, but not at the expense of profit

- Could “rent” market share (referring to worrying solely on increasing sales)

- Problem with naked shorting

- Lending SHLD treasury shares is not the right was for the co. to make money

- Commented on status of credit line renewal (good news)

- Availability of credit to make acquisitions

- Sufficient access to credit for operations or acquisitions

- Credit markets have improved

- Types of funding, cost will change

- On a relative basis, they would have been as good repurchasing stock at $160 (which they of course did) as almost anything else. (No regret to speak of from the Chairman here)

- Store-in-store prototypes are not getting specialty retailing results

- Lands’ End is a much more stable business

- Competing for customers not against competitors

-Question about insiders selling SHLD stock (Perry Corp., Richard Perry’s firm had recently shed over half its position)

- Insiders sell stock all the time

- Will sell stock at some point (not something I was fond of hearing)

- Know your goals, when you will need money

- They have constructed a board of owners

Seth Klarman Video

The University of Western Ontario Ivey School of Business posted a videoconference with Seth Klarman. Klarman is the founder of The Baupost Group and a very successful value investor. The video which lasts just over an hour, was taped in March. Thanks go to the Ivey School for sharing such a valuable resource!

The video can be found here: Enjoy!

My New Favorite Website

Last month, the New York Times DealBook created a website called Perks Watch. I love it. They search through proxy filings looking for ridiculous perquisites awarded to managers of America’s largest companies. Call me an idealist, but I would be either embarrassed or outraged if I worked for or owned these companies. At the very least it is good for a laugh and/or shake of the head. Here is one example:

Mattel: “According to the proxy statement that Mattel filed Monday with the Securities and Exchange Commission, Mr. Eckert appears to have joined a new country club — with Mattel picking up the $150,000 initiation fee.”

Tom Russo – Columbia Business School Speech

Here is a link to a presentation given by Tom Russo to a value investing class taught by Bruce Greenwald at Columbia Business School on February 26th. Worth watching..

Thomas A. Russo, Gardner Russo & Gardner

Thomas A. Russo joined Gardner Russo & Gardner as a partner in 1989. Eugene Gardner, Thomas Russo and Eugene Gardner, Jr., as partners, each manage individual separate accounts and share investment approaches and strategies. In addition, Thomas Russo serves as General Partner to Semper Vic partnerships. Mr. Russo oversees $4 billion through separately managed accounts and partnerships. Gardner Russo & Gardner is a registered investment adviser under the Investment Advisers Act of 1940, and is not associated with any bank, security dealer or other third party.

Mr. Russo’s investment philosophy emphasizes return on invested capital, principally through equity investments. His approach to stock selection stresses two main points: value and price. While these would seem to be obvious key considerations in any manager’s approach, it is equally obvious that all too often they are either misjudged or, perhaps more frequently, simply not viewed together.

Mr. Russo looks for companies with strong cash-flow characteristics, where large amounts of “free” cash flow are generated. Portfolio companies tend to have strong balance sheets and a history of producing high rates of return on their assets. The challenge comes in finding these obviously desirable situations at reasonable or bargain prices.

Mr. Russo’s investment approach is focused on a small number of industries in which companies have historically proven to be able to generate sustainable amounts of net free cash flow. (These industries typically have included food, beverage, tobacco, and advertising supported media.) This fairly narrow approach reflects his training and discipline at the Sequoia Fund in New York, where he worked from 1984 to 1988. Mr. Russo tries to limit risk by not paying too large a multiple of a company’s net free cash flow in light of prevailing interest rates. He attempts to broaden this otherwise narrow universe by including companies with smaller market capitalizations and companies in similar industries based abroad.

Mr. Russo’s goal is one of an absolute return rather than a relative return, and he continues his long-term investment objective of compounding assets between 10 and 20 percent per year without great turnover, thereby realizing a minimum amount of realized gains and net investment income.

Thomas A. Russo is General Partner of Semper Vic Partners, L.P., and Semper Vic Partners (Q.P.), L.P., limited partnerships whose combined investments exceed $1 billion, along with overseeing substantially more funds through separate accounts for individuals, trusts, and endowments. He is a graduate of Dartmouth College (B.A., 1977), and Stanford Business and Law Schools (JD/MBA, 1984). Memberships include California Bar Association and Board of Visitors for Stanford Law School. Mr. Russo is a charter member of the Advisory Board for the Heilbrunn Center for Graham & Dodd Investing at Columbia Business School. He is a member of Dartmouth College’s President’s Leadership Council.

For further information on Tom Russo and his fund which has performed quite well over the years I refer you to the following presentation slides from November 2008…

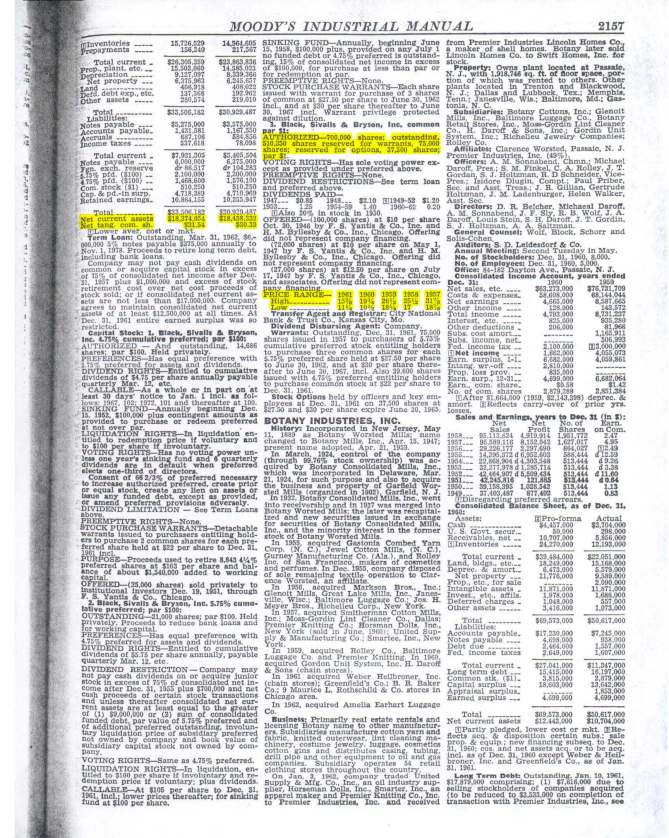

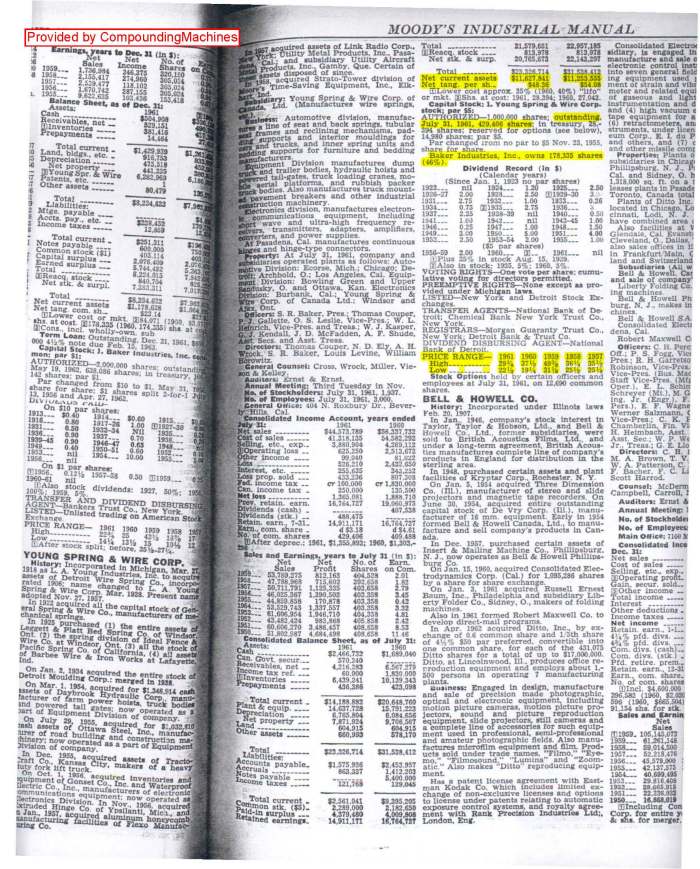

Young Spring & Wire Corp.

As readers of this blog know, I am fascinated by investments the Buffett Partnership made in the 1950s-1960s. Back then with limited capital, Buffett could invest money in virtually any company regardless of size. For example, at year-end 1962 Dempster Mill Manufacturing was the largest position (23% of the portfolio). Dempster had a market cap at the time of $3.1 million, or about $21 million in today’s dollars. Below is another mini-case study.

The following is the Moody’s sheet from 1962 for Young Spring & Wire Corp. It was the 7th largest position at year-end 1962, or about 5% of assets. BPL owned 19,165 shares, or about 4.5% the company. As with investments discussed previously, it is impossible to know when and at what price Buffett first purchased the stock, but he did “dance” in and out of positions more frequently back then.

Young Spring & Wire had three business lines including: automotive (seat and back springs), equipment (dump truck and trailer bodies, etc) and electronics (receivers, transmitters, amplifiers, etc.). The company had lost money in 1960 and 1961 (-$1.9 mm and -$1.4 mm respectively) which leads me to believe this was yet another Ben Graham-type balance sheet bargain. Indeed, the company was debt-free with $3 million of cash and equivalents and net current assets of $27 per share and net tangible assets of $48.36 per share. At $25.50, the company had a market cap of $10.9 million ($76 million in today’s dollars). This investment was likely made based on the fact that it was trading below both net current asseets and tangible book value.

I hope others find these mini case studies intersting as well.

Sears Holdings – Chairman’s Letter

Sears Holdings owners really only have two chances per year to find out what is on the mind of the company’s Chairman, Eddie Lampert. One is the annual meeting in May and the second is the annual shareholder letter which was released this morning concurrent with the release of Q4 and full-year 2008 results. Here is the link to the letter:

http://searsholdings.com/invest/

Here are a couple notable pieces from the letter including a couple book recommendations:

The two most important books that any student of current events should be reading in this environment are both by Friedrich Hayek, the esteemed Austrian economist. Based on events he witnessed beginning in the early part of the 20th century, Hayek wrote The Road to Serfdom as a warning to England and the United States against the damaging impact of socialist policies and The Fatal Conceit as a warning against heavy intervention in markets and society at large. Despite the almost universal belief today that more, but better, regulation is needed and that the role of the state needs to be not just temporarily larger, but permanently larger, Hayek’s writings and logic should give everybody pause as to the consequences of these actions.

As a country, we need to rebuild confidence and trust and to understand what happened. Whether by business or by government, the misdiagnosis of situations leads to poor prescriptions for rehabilitation and recovery. When the misdiagnosis is done at the federal government level and involves large parts of a national economy, the consequences can be swift and significant. The unintended consequences are often swifter and even more significant. As the leaders in our nation continue to evaluate and evolve the policies and rules of the game, we would all be wise to heed the cautions raised by Friedrich Hayek. I appreciate that the free market can be a difficult master and that there is an important role for government and regulators, but I hope that as we move forward the rules of the game and the methodology for changing those rules will be more consistent and fair than they have been over the past year. Those who desire to protect civil liberties in times of war appreciate the importance of laws protecting individuals and institutions. In times of economic and financial distress we need to be similarly vigilant in protecting economic and contract rights so that we can continue to have a system that functions properly. Attempts to threaten or eliminate those rights will chase away the capital and investment that our country needs to restore prosperity and to thrive in the future.

I agree with Lampert’s view that what market participants ultimately need in order to begin restoring confidence is an understanding of the rules of the game and some certainty that those rules won’t change in an instant, which has been the case lately.

=========================

As discussed at the 2008 Annual Shareholder Meeting, there has been significant expansion over the past five years in big box retail square footage and significant capital expenditures by our competitors, primarily for opening new stores, but also to refresh and expand their existing store base and infrastructure. At Sears Holdings, our investment principle is guided by the belief that capital invested in any area of our business deserves a reasonable return on that investment. If that return is not forthcoming, significant investments in the business will destroy value rather than create value for shareholders.

Over the past several months, many of our competitors have announced dramatic reductions in their capital expenditure budgets for 2009 and beyond. Perhaps they too are recognizing that unbridled expansion and investment rarely yield the types of returns forecasted by analysts and industry experts. The dramatic increases in capital investment in the retail industry that took place in recent years are being reversed, and investment levels are being reevaluated. I think that ultimately this is a healthy dynamic for the entire industry. Retail is not immune from the economics of overexpansion experienced in other industries. At Sears Holdings, we will continue to evaluate opportunities based upon our expectations for returns and continue to experiment with a variety of options where the returns could justify higher levels of investment.

The Chick-Fil-A Owner/Operator Model

On Thursday, Chick-Fil-A reported unbelievable 2008 sales figures including record system-wide-sales of nearly $3 billion, a 12.2% increase from 2007 and a very impressive same-store-sales increase of 4.6%. 2008 was its 41st consecutive year of system-wide sales gains.

In case you are not familiar with Chick-Fil-A, it is the second largest U.S. quick service chicken restaurant chain with nearly 1,425 locations in 38 states. They are known for being the first fast food chain to offer boneless chicken breast sandwiches and chicken nuggets and the first to locate inside of shopping malls. To learn more about the history and the guiding principles of the company, I recommend reading Eat Mor Chikin Inspire More People: Doing Business the Chick-Fil-A Way by company founder, S. Truett Cathy. You will learn that the values espoused by Cathy that makes the company the success that it is today are simple, but not easy to execute consistently day in and day out (except Sundays!).

What really makes Chick-Fil-A different from its competitors is its Operator model. Most restaurant companies have minimum net worth requirements for their franchisees, usually exceeding $1 million, of which up to $500,000 of liquid net worth is needed just to get the first restaurant up and running. From there, the franchisee must pay the franchisor an ongoing royalty fee of around 4-6% of gross sales and around 3- 5% of gross sales for an advertising fee. If the franchisor owns the land underneath the restaurant, another fee is charged to the franchisee for rent which is usually in the neighborhood of 6-9% of sales. This percentage of sales arrangement makes franchising a fantastic business. A pure franchising model can produce up to 50-60% EBITDA margins with very little capital required.

Chick-Fil-A does things a bit differently. In fact, Chick-Fil-A really doesn’t really franchise restaurants in the traditional sense since they retain the equity in its restaurants. What they really do is recruit young, hungry entrepreneurs that embody the Chick-FIl-A values, then offer them an attractive profit sharing program. The company gives the Operator all the tools it needs to succeed, but from there the Operator is the “CEO, manager, president, and treasurer of his or her own business.” At the Steak n Shake Investor Day in November of 2008, Sardar Biglari commented that he loves the Chick-Fil-A owner/operator model. I suspect and hope this admiration will eventually lead to emulation.

You don’t have to be worth millions to be a Chick-Fil-A Operator, instead you have to pay an upfront fee of $5,000 (just to prove you are serious I guess). From there, Chick-Fil-A pays for everything to get the restaurant up and running including real estate and equipment which they then sublease to the Operator. Chick-Fil-A charges 15% of gross sales, and then splits the net profit 50/50 with the Operator. Under this arrangement, most Operators are able to make over $100,000 per year. The company doesn’t do too shabby either. They have a disciplines growth strategy, building only 75-100 new stores per year, reportedly taking on only modest amounts of debt to build each location. I can’t see how the company could be doing anything but printing cash.

This system produces entrepreneurial owner/Operators that are both emotionally and financially committed to the business. As Cathy said, “the bottom line depends on the Operator’s honesty, integrity, commitment, and loyalty to customers and to us. We trust our Operators to make good decisions – and they do.”

Below are the tenets Operators are expected to adhere to (from Eat Mor Chikin: Inspire More People):

- People want to work with a person, not for a company

- Each new Operator is committed to a single restaurant

- Operators will hold no outside employment or other business interest

- We choose Operators for their ability and their influence, so we want them in the their restaurants

- We expect quality interaction between Operators and team members

- We expect quality interaction between Operators and customers, both in the restaurant and in the community